– Fourth Quarter Total SaaS Revenue Grows 36% Year-Over-Year

– Full Year 2021 Total SaaS Revenue Grows 32% Year-Over-Year

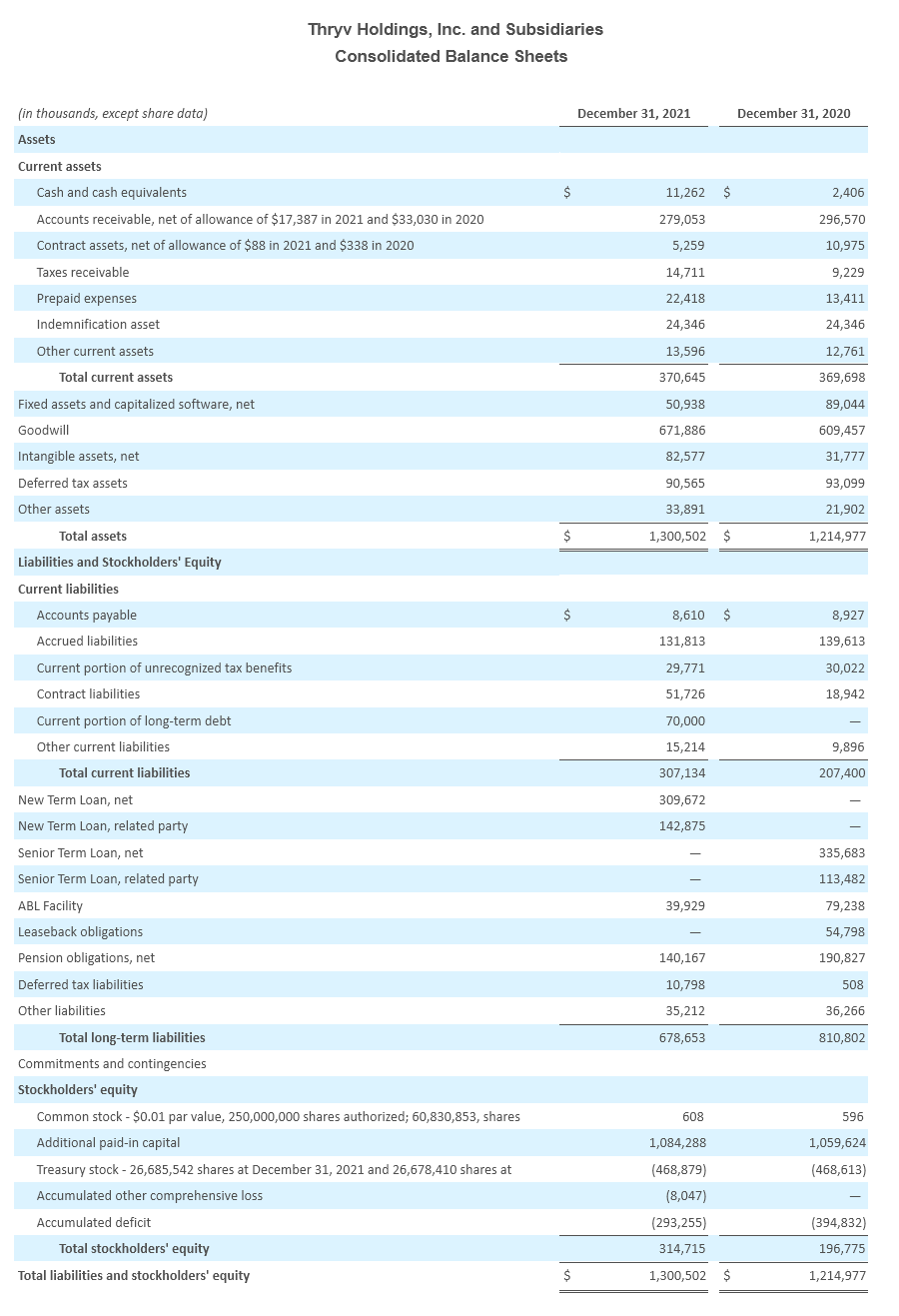

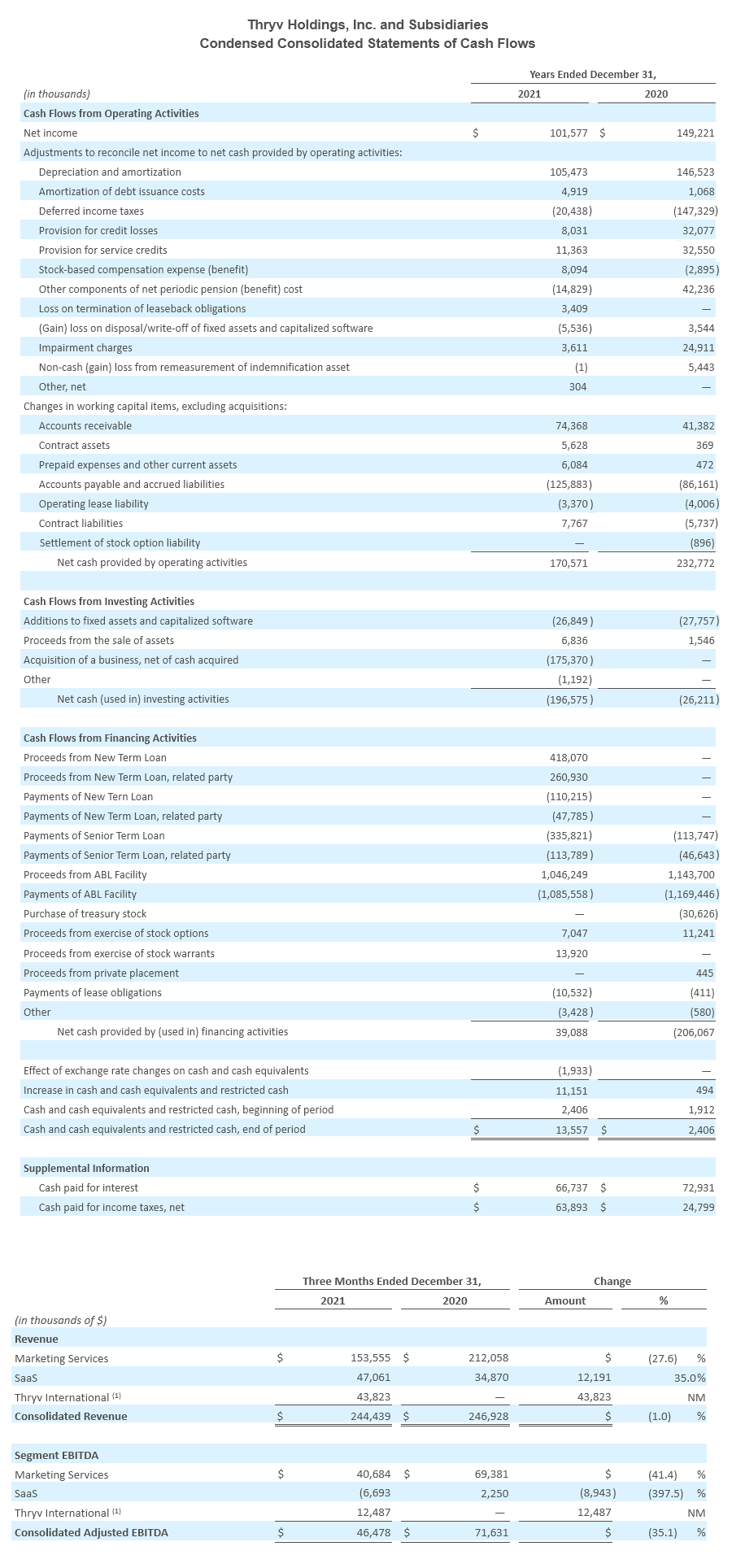

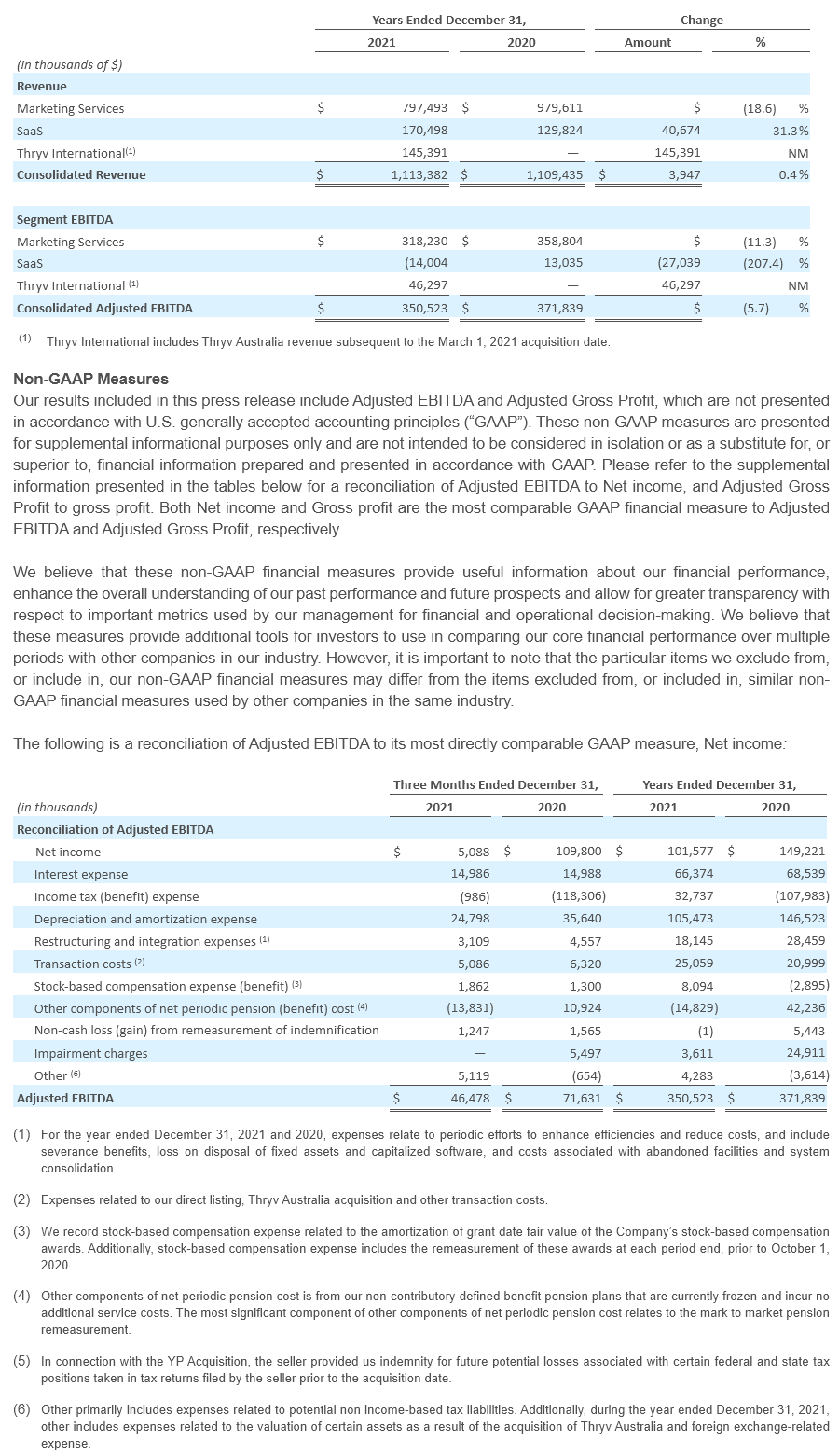

DALLAS, March 10, 2022 – Thryv Holdings, Inc. (NASDAQ:THRY) (“Thryv” or the “Company”), the end-to-end client experience platform for growing small businesses, announced audited financial results for the fourth quarter and fiscal year 2021. The Company has also provided guidance for first quarter and full year 2022.

“We are pleased to report a strong finish to 2021, with Q4 representing our largest SaaS revenue quarter on record,” said Joe Walsh, Chairman and CEO. “We beat all of our 2021 guidance targets. These outstanding results confirm that Thryv has become the leader in moving small to medium-sized businesses to cloud software to enable them to modernize and run their businesses.”

The Company also announced that it has acquired Vivial Media Holdings, Inc. (“Vivial”), a regional provider of small business digital and print marketing services, for $21 million. On a post synergy basis, the purchase price of Vivial corresponds to an enterprise value / adjusted EBITDA multiple of approximately 2x, consistent with Thryv’s disciplined acquisition strategy and prior marketing services acquisitions.

“Vivial has a strong presence in key US markets including Hawaii, Alaska, Cincinnati, Ohio, Rochester, New York, and Lincoln, Nebraska,” said Walsh. “These fit synergistically into Thryv’s national platform. We are confident that many of Vivial’s 25,000 digital customers will adopt Thryv’s CRM software.”

“With the highly-profitable Marketing Services business providing low-cost leads into the SaaS business, the Company will continue to generate strong EBITDA margins from a consolidated standpoint,” said Paul Rouse, Chief Financial Officer. “We have a strong track record of optimizing profits and we believe this trajectory will continue throughout 2022.”

“Finally, we look forward to sharing more of the long-term vision at our upcoming in-person investor and analyst day in New York City on April 5th,” concluded Walsh.

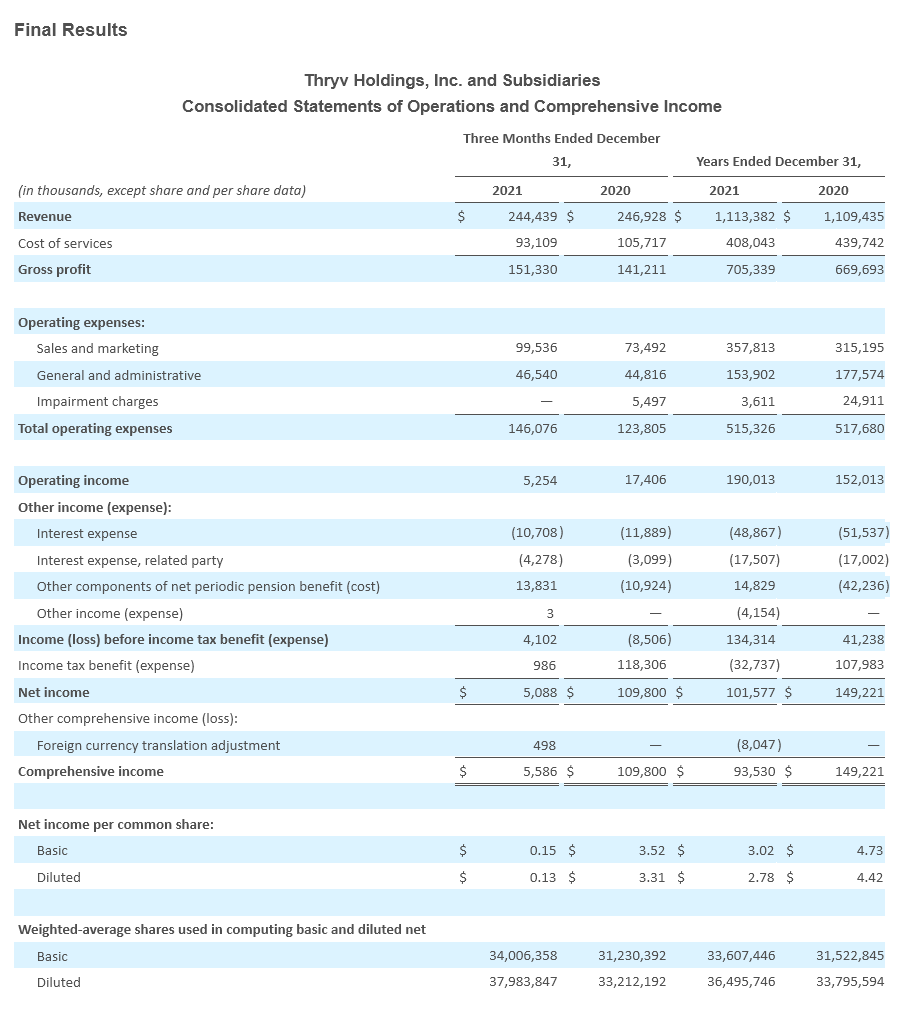

Fourth Quarter 2021 Financial Highlights:

- US SaaS revenue was $47.1 million, a 35.0% increase year-over-year

- US Marketing Services revenue was $153.6 million

- Thryv International revenue was $43.8 million

- Consolidated total revenue was $244.4 million, a decrease of 1.0% year-over-year

- Consolidated net income was $5.1 million

- Consolidated adjusted EBITDA was $46.5 million, representing an adjusted EBITDA margin of 19.0%

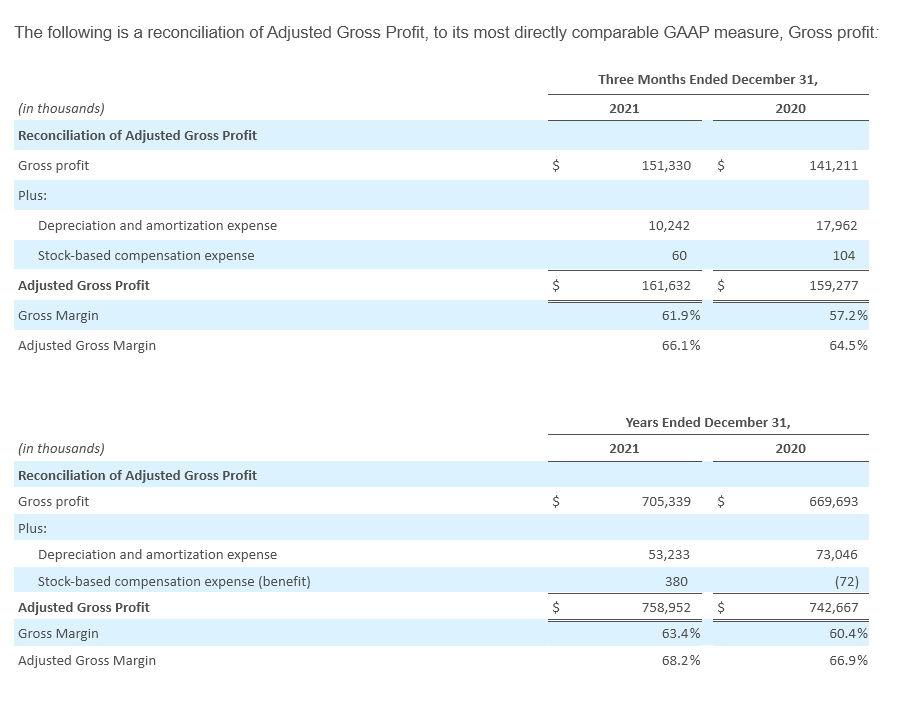

- Consolidated gross profit was $151.3 million, an increase of 7.2% year-over-year

- Consolidated adjusted gross profit was $161.6 million

Full Year 2021 Financial Highlights:

- US SaaS revenue was $170.5 million, a 31.3% increase year-over-year

- US Marketing Services revenue was $797.5 million

- Thryv International revenue was $145.4 million

- Consolidated total revenue was $1,113.4 million, an increase of 0.4% year-over-year

- Consolidated net income was $101.6 million

- Consolidated adjusted EBITDA was $350.5 million, representing an adjusted EBITDA margin of 31.5%

- Consolidated gross profit was $705.3 million, an increase of 5.3% year-over-year

- Consolidated adjusted gross profit was $759.0 million

SaaS Highlights

- SaaS Average Revenue per Unit (“ARPU”)1 increased to $351 for the fourth quarter of 2021, compared to $293 in the fourth quarter of 2020

- Total SaaS clients increased to 46 thousand for the fourth quarter of 2021

- SaaS Monthly Churn2 was 2.1% for the fourth quarter of 2021, compared to 2.4% for the fourth quarter of 2020

- SaaS Monthly Seasoned Churn3 improved to 1.5% for the fourth quarter of 2021

- Net Dollar Retention4 improved 5 percentage points to 88% at end of the fourth quarter of 2021, when compared to the fourth quarter of 2020

- Seasoned Net Dollar Retention5 improved 4 percentage points to 94% at end of the fourth quarter of 2021, when compared to the fourth quarter of 2020

- SaaS monthly active users1 increased 7.1% year-over-year to 30 thousand active users. Daily and Weekly users increased 12.3% year-over-year.

2021 Product Innovation and Accolades

- Google My Business Optimization service launched to help small businesses get found online and chosen over their competition

- Free Online Tools launched, including invoice generator, Google review link generator, Online Experience Scan, as well as several calculators and quizzes to improve business practices

- Google My Business Dashboard launched, to centralize all-things Google for small businesses

- Gmail Email Service integration with Thryv launched

- Fully-integrated Verticalized Platform with enhanced CRM launched

- G2: Leader in 14 categories

- Capterra Highest-Rated Marketing Software to Help Your Business Succeed in 2022

- Top 10 CIO Applications Customer Service Solution Providers

- MyTechMag Top 10 CRM Solution Provider

- Appealie Overall SaaS Award – Customer Service

- Appealie SaaS Customer Success Award

- GetApp Category Leaders: Social Media Marketing, Lead Management, Reputation Management, Real Estate CRM and Review Management

- Software Advice Front Runners: Social Media Marketing, Lead Management, Account Management

Outlook

Based on information available as of March 10, 2022, Thryv is issuing guidance7 for the first quarter and full year 2022 as indicated below:

For the first quarter 2022, the Company expects:

- Total SaaS revenue range of $47.5 to $47.7 million

- Total SaaS EBITDA loss of $12 to $13 million

- Total Marketing Services revenue range of $238 to $240 million

For the full year 2022, the Company currently expects:

- Total SaaS revenue range of $206 to $208 million

- Total SaaS EBITDA loss of $21 to $25 million

- Total Marketing Services revenue range of $870 to $890 million

- Total Marketing Services EBITDA of $305 to $312 million

Earnings Conference Call Information

Thryv will host a conference call on Thursday, March 10, 2022 at 8:30 a.m. (Eastern Time) to discuss the Company’s fourth quarter and full year 2021 results. The conference call will be available via the Internet at investor.thryv.com. There will be several slides accompanying the webcast. Please go to the website at least 15 minutes prior to the call to register, download and install any necessary software. The recorded webcast will also be available on the Company’s website.

If you are unable to participate in the conference call, a replay will be available. To access the replay, please dial (800) 770-2030 or (647) 362-9199 and enter “87769.”

1 Defined as total client billings by month divided by the number of revenue-generating units during the month.

2 Calculated as the percentage decrease in billable clients in the current month compared to the prior month.

3 SaaS Monthly Seasoned Churn is defined as monthly churn excluding clients acquired over the previous 12 months.

4 Defined as the percentage of revenue from clients with monthly billed revenue in the current month compared to the same month in prior year.

5 Seasoned Net Dollar Retention is defined as net dollar retention excluding clients acquired over the previous 12 months.

6 Defined as a client with one or more users who log into our SaaS solutions at least once during the calendar month.

7 These statements are forward-looking and actual results may materially differ. Refer to the “Forward-Looking Statements” section below for information on the factors that could cause our actual results to materially differ from these forward-looking statements.

Forward-Looking Statements

Some statements included in this release constitute forward-looking statements. Statements that include the words “may”, “will”, “could”, “should”, “would”, “believe”, “anticipate”, “forecast”, “estimate”, “expect”, “preliminary”, “intend”, “plan”, “project”, “outlook”, “future”, “forward”, “guidance” and similar statements of a future or forward-looking nature identify forward-looking statements. These statements are not guarantees of future performance. Forward-looking statements provide current expectations with respect to our financial performance and future events with respect to our business and industry in general. Forward-looking statements are based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to, the risks related to the following: risks related to the ongoing COVID-19 pandemic, the Company’s ability to maintain adequate liquidity to fund operations; the Company’s future operating and financial performance; the Company’s ability to consummate acquisitions, or, if consummated, to successfully integrate acquired businesses into the Company’s operations, the Company’s ability to recognize the benefits of acquisitions, or the failure of an acquired company to achieve its plans and objectives; limitations on our operating and strategic flexibility and the ability to operate our business, finance our capital needs or expand business strategies under the terms of our credit facilities; our ability to retain existing business and obtain and retain new business; general economic or business conditions affecting the markets we serve; declining use of print yellow page directories by consumers; our ability to collect trade receivables from clients to whom we extend credit; credit risk associated with our reliance on small and medium sized businesses as clients; our ability to attract and retain key managers; increased competition in our markets; our ability to obtain future financing due to changes in the lending markets or our financial position; our ability to maintain agreements with major Internet search and local media companies; reduced advertising spending and increased contract cancellations by our clients, which causes reduced revenue; and our ability to anticipate or respond effectively to changes in technology and consumer preferences. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by such cautionary statements.

If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. For these reasons, we caution you against relying on forward-looking statements. All forward-looking statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. These forward-looking statements speak only as of the date hereof and, other than as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

About Thryv Holdings, Inc.

Thryv Holdings, Inc. (NASDAQ: THRY) is a global software and marketing services company that empowers small- to medium-sized businesses (SMBs), franchises and agencies to grow and modernize their operations so they can compete and win in today’s economy. Over 45,000 businesses use our award-winning SaaS platform, Thryv®, to manage their end-to-end customer experience, which has helped businesses across the U.S. and overseas grow their bottom line. Thryv also manages digital and print presence for over 400,000 businesses, connecting these SMBs to local consumers via proprietary local search portals and print directories. For more information about Thryv Holdings, Inc, visit thryv.com.

Media Contact:

Morisa Young

Gregory FCA

347.428.4325

[email protected]

Investor Contact:

Cameron Lessard

Thryv, Inc.

214.773.7022

[email protected]